F2H Capital Group is an NYC-based real estate investment group with a history of delivering outstanding results to investors and communities.

We are offering strategic investors an opportunity to invest in our fund, “F2H Value Add Fund 1”

Inquire Now20-23% IRR

with a targeted 2-5 year hold.

Powered by Proven Strategy

Leveraging vertical integration, uniquely hands-on

construction management and data-driven deal flow.

Built with Aligned Incentives

We invest our own capital in each of our investments,

along with our partners.

Performance-driven pay model

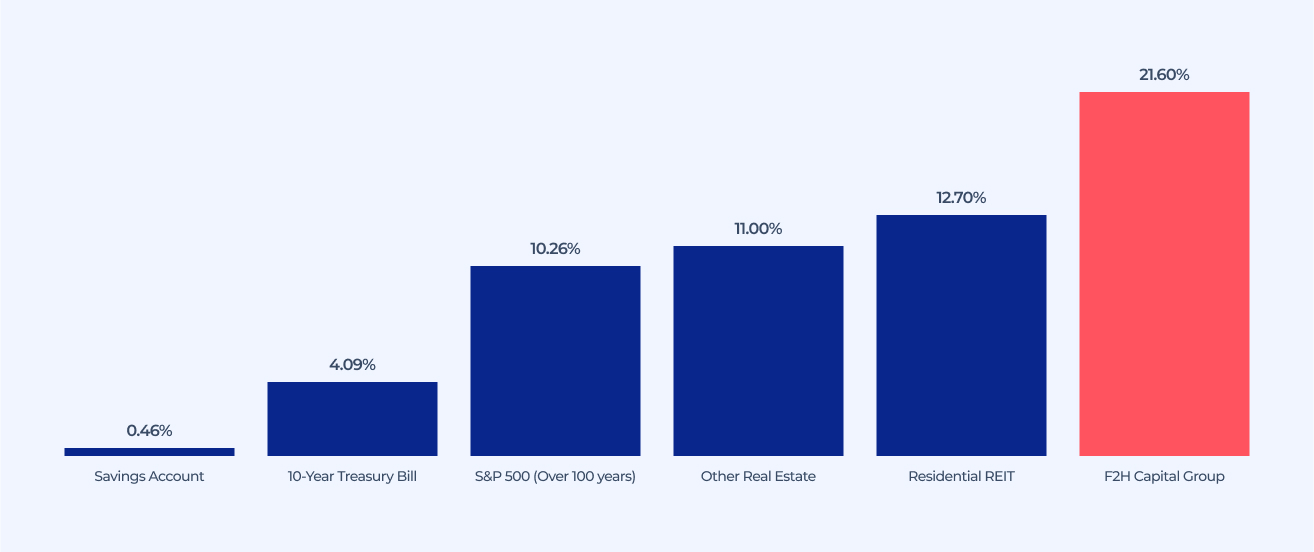

Historical Performance in the NYC Market

$135M

Assets Under Management21.6%

IRR (5-Year Avg.)2.46X

Equity Multiple on Investments2-5 Years

Hold Period

We are offering strategic investors an opportunity to invest in our fund, “F2H Value Add Fund 1”

Our investments have a minimum of an 20-23% return with a targeted 2–5 year hold.

Our Mission

We specialize in strategic investment and development of multifamily and mixed-use properties.

Beyond financial returns, we seek to enrich community well-being & sustainability in urban landscapes, creating lasting value for tenants, investors, and communities.

Inquire Now

Investment Strategy – Overview

Repositioning Vacant Properties

Property modernization and optimization via renovation and reconfiguration

Strategically planned for tax optimization & below-market property acquisition.

Ground-Up Development Projects

Creating community-aligned, sustainable spaces

Strategically planned to meet market trends & demand

Investment Model

Our investment model is a fund structure that puts you first.

The prioritized investment model ensures that we remain focused on ensuring we only engage with the best possible opportunities in the marketplace.

Targeted IRRs to fund investors, net of fees is 20-23%.

Inquire Now

The Fund’s structure puts our investors first. 100% of available distributions are paid to investors as follows:

INVESTORS ACCRUE AN

8% CUMULATIVE

Preferred return on invested equity

INVESTORS RECEIVE

100% RETURN

Of original principal invested after 8% preferred

PROFIT-SHARING

80% / 20%

Investors / F2H Capital

Investment Strategy - Execution

Driving cost savings, efficiency, and higher ROI while mitigating risks

Vertical Integration

F2H manages every aspect of our projects internally— from site

acquisition and design to construction and property management.

This ensures seamless execution, optimal efficiency and alignment with our strategic vision.

Construction Hyper-Management

F2H has an unusually focused, hands-on approach with strict quality control, timeline adherence, and optimized workflows.

Material Sourcing

Sourcing and bulk purchasing for high-quality, cost-effective materials, mitigating supply chain issues.

Investment Strategy Deal Flow

We focus on off-market deals for low-competition opportunities & advantaged negotiation and acquisition of undervalued properties. Driven by a vast network of industry professionals, including brokers, estate & bankruptcy attorneys

How We Acquire Property

F2H has developed a proprietary dual-sourcing deal flow strategy to create opportunities regardless of market cycle. Historically, F2H has been able to source ±30 deals per month, giving us the ability to be highly selective in our review process.

Joint Venture (JV)

We have established numerous partnerships across NYC and surrounding areas from which we seek real estate investment opportunities, allowing us to capitalize on local knowledge and relationships to find deals. The joint venture acquisition strategy is focused on finding real estate in positive economic markets with job and population growth.

Key Relationships: Foster relationships with local real estate partners.

Diversity: By geographic, asset type and partner/sponsor.

Deal Flow: Critical selection of the smartest investments possible.

Direct Acquisitions

This acquisition strategy falls within target asset classes (i.e., apartments, and mixed use) and includes states where F2H is located, or a state where we have long-established and historical relationships.

10+ Years Experience: Acquisitions and relationships are time tested and proven

Local Staff: Ability to manage with “boots on the ground

Reach: Owning and operating multiple properties within a given MSA

Why Invest in F2H Capital Group?

Additionally, RE is backed by real assets, unlike crypto or certain securities.

Inquire Now

Inquire Now

Mergers & Acquisitions

Post-acquisition, we provide the strategic guidance, financial backing, and operational infrastructure needed to scale. From refining systems to expanding market reach, our team supports sustainable growth without compromising the culture or integrity of the business.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Asperiores autem debitis dolorem, magnam natus neque optio quidem quis sed tempore.

Lorem ipsum 222 dolor sit amet, consectetur adipisicing elit. Asperiores autem debitis dolorem, magnam natus neque optio quidem quis sed tempore.

Our Real Estate Case Study

359 W 48th St, New York, NY

Multifamily

35,840

39

148-150 Clinton St, Brooklyn, NY

Multifamily

15,512

15

356 W 48th St, New York, NY

Multifamily

9,950

20

140 Mulberry St, New York, NY

Mixed-use

9,900

10

96-98 Coffey St, Brooklyn, NY

Townhomes

8,000

2

43 W 8th St, New York, NY

Mixed-use

6,729

8