back

The Impact of Property Tax Assessments on Real Estate Investments

04-2023

For many people, investing in real estate can be a successful business option. Property tax assessments are just one of many variables that might affect how profitable real estate investments are. A real estate property’s value and return on investment can be greatly impacted by property tax assessments. We will examine the effects of property tax assessments on real estate investments in this blog and offer suggestions on how investors can lessen these effects.

Property Tax Assessments 101

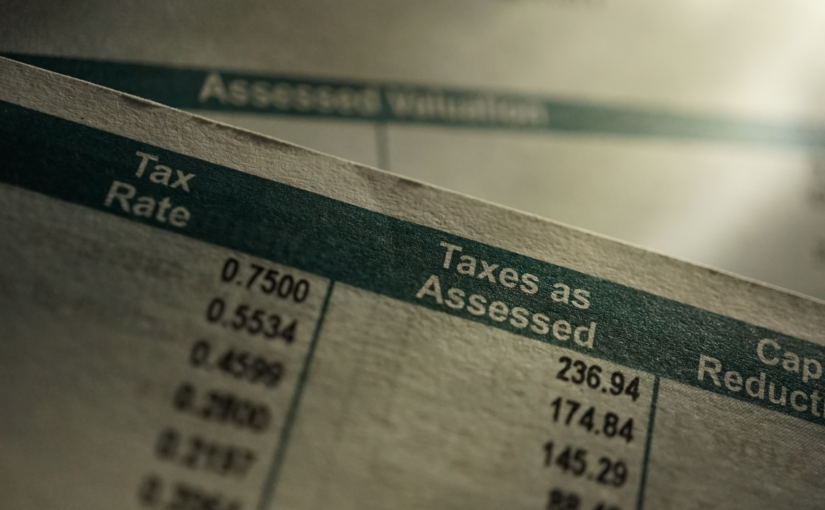

It’s crucial to comprehend what property tax assessments are before diving into how they affect real estate investments. Local government entities conduct property tax assessments to establish the value of a property for taxation reasons. The property owner’s obligation to pay property taxes is determined using this valuation. Property tax assessments take into account a number of variables, including the location, size, age, and condition of the property. Localities may utilize different tax rates and assessment techniques.

Impact of Property Tax Assessments on Real Estate Investments

Real estate investments may be significantly impacted by property tax assessments. Increased property taxes can lower a property’s net operating income (NOI), which lowers its profitability. One of the biggest costs of owning real estate is often the payment of property taxes. Increased property taxes may have an impact on the property’s total value and the cash flow it generates.

A real estate property’s value can also be impacted by property tax assessments. Higher assessed values may be used to set prices for properties since they are thought to be more valuable. In contrast, properties that are evaluated at a lower value can be thought of as having less worth and hence selling for less money. This may affect a property’s return on investment.

The demand for a real estate property can also be influenced by property tax assessments. A property’s demand may decline as a result of higher property taxes deterring prospective buyers or tenants. On the other hand, decreasing property taxes may increase a property’s demand by enhancing its appeal to prospective tenants or buyers.

Mitigating the Impact of Property Tax Assessments on Real Estate Investments

Investors can reduce the effect of property tax assessments on their real estate investments in a number of ways. One strategy is to perform careful due diligence before making an investment in real estate. Investigating the local property tax rates and assessment practices is part of this. Investors want to think about hiring a qualified appraiser to determine the property’s value on their own.

Appealing the assessment if it is thought to be too high is another approach to lessen the effects of property tax assessments. If a property owner believes that their property tax assessment is incorrect or unfair, they have the right to appeal the decision. This can be a laborious and complicated process, but it might save you money on your property taxes.

Property investments in regions with reduced property tax rates are another option for investors. This may assist in lowering the property tax costs linked to real estate ownership.

Investors should be aware of any changes to the local property tax rates and assessment procedures. Investors must stay current on changes to property tax rates and assessment procedures in order to make wise judgments. When formulating their overall investment strategy, investors should also take the potential impact of property tax assessments into account. Investors can make educated investment decisions that are financially healthy and in line with their overall investment goals by taking into account how property tax assessments affect real estate investments and keeping up with changes in local property tax rates and assessment practices.

Real estate investments may be significantly impacted by property tax assessments. A property’s profitability and overall worth may be impacted by higher property taxes. However, by carrying out careful due diligence, contesting assessments if necessary, and purchasing properties in regions with lower property tax rates, investors can lessen the burden of property tax assessments. Investors can make financially prudent investment decisions by being aware of the effects of property tax assessments on real estate assets and taking the necessary steps to reduce these effects.

F2H Capital Group is a debt advisory firm specializing in negotiating the best terms for your commercial real estate projects. The company offers a range of financial products and services, including fixed loans, bridge loans, and construction loans across all asset types. Please contact us for any of your financing needs.